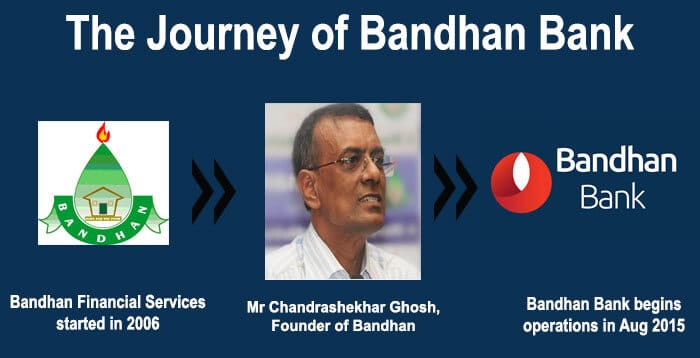

In 2006 the NGO acquired the Non-Banking Finance Company (NBFC) license of Ganga Niryat Pvt Ltd and transformed itself into an NBFC called Bandhan Financial Services Ltd. Once Bandhan transformed into an NBFC, it saw enormous growth and reached a loan outstanding of Rs 5000 Crore and a borrower base of more than 50 Lakh by early 2013.

As Bandhan had grown enormously, the Reserve Bank of India (RBI) decided in April 2014 to give a preliminary license to Bandhan Financial Services so that it can convert itself into a bank. Bandhan was chosen from a group of more than 25 bank license applicants because of it’s outstanding work in microfinance, rural branch network and social mission. The reason why RBI is issuing new bank licenses in India is that it wants to encourage banks to expand their branch network in rural areas. Many of India’s leading Pvt and public sectors banks are reluctant to do so because of the low profitability of rural branches. It is this gap in the banking service network that RBI wants Bandhan and other new banks to occupy.

Investors in Bandhan

Bandhan Bank is currently not a listed company on the BSE / NSE, so investors such as the public cannot purchase its shares. However, the Private Investor community has reposed its faith in its banking model and it successfully raised Rs 1020 Crore in May 2015 from foreign investors like the IFC and World Bank. The foreign investors have not disclosed at what share price and premium they have invested in Bandhan bank.

Bandhan Bank Begins Operations

With all hurdles cleared, Bandhan Bank formally started operations on August 23, 2015, after more than a year of restructuring, planning and capital raising. Within a month by September 23, 2015, Bandhan Bank had added more than 5 lakh customers taking its total customer base to 83 lakhs. This is an incredible feat for a small bank such as Bandhan and has surprised many of the stalwarts of the Indian Banking industry. It began operations with 501 bank branches, the majority of which are in West Bengal and North India and it has also established branches in all the metropolitan cities. Bandhan bank has converted it’s microfinance branches into “Point of Sales” branches and these numbers more than 2000. Concurrently it has also managed to establish more than 50 ATMs across the country.

Bandhan Bank Share Price and IPO

Bandhan Bank has announced that it is planning to come out with an Initial Public Offer (IPO) in 2018. As per RBI guidelines, all new banks are mandatorily required to be listed within 3 years of starting banking operations. Since Bandhan began operations only in August 2015, you can expect it’s shared to be listed on the stock exchanges before August 2018. When it comes out with an IPO in 2018, the public will be able to acquire its shares at a favorable price but its share price will be dependent on how it’s business grows in these 3 years.

Future of Bandhan Bank

Bandhan Bank has a capital base of only Rs 3,200 Crore, this is quite low for a new bank. Hence the bank does not plan to immediately start disbursing loans and has instead launched pilot programs of its new products and services. It has decided to focus more on deposit-taking from its existing customer base who were until now, not allowed by regulatory norms to deposit their savings with Bandhan. In September 2015, RBI granted 10 more special banking licenses called “Small Finance Bank License“. Eight microfinance companies were recipients of this banking license and they are expected to commence their operations next year. This will increase the competition among new banks and could affect the profitability of Bandhan Bank in the long run.