How to Find PAN Number using Mobile Number

As you may know, mobile numbers are required to be linked to Aadhaar and PAN card to make them more secure. It also helps in better identification. In many cases, you can use your mobile number to verify Aadhaar and PAN card. In the same way, you can use your mobile number to find your PAN number. But before that, let us understand the purpose of PAN card.

What is a PAN Card?

PAN card stands for Permanent Account Number which is a 10-character long combination of alphabets and numbers given by the people to the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes. The main purpose of a PAN card is to act as an identification document, proof of Birth Date, and to be used for Taxation. If a foreigner can produce a valid visa then they can get a PAN card too and hence the card is not used as proof of Indian citizenship. A PAN card is a must for filing income tax returns. The structure of the PAN card has been made by putting a lot of thought into it. They are not just random numbers and letters put together; the pattern gives away some important details about the holder. The PAN number starts with five capital letters followed by four numbers and a solitary capital letter at the end. The first three letters are a sequence of letters ranging from AAA to ZZZ. The fourth letter is A, B, C, F, G, H, L, J, P, or T depending on what body the cardholder belongs to, like company, firm, etc. The fifth character is the first letter of a name, surname, or last name of a person. In the case of a personal card, the letter P is used as the fourth character. Meanwhile, in the case of firms, companies, etc. the fourth letter is one of the letters mentioned above depending on what body the owner of the card belongs to. The last letter which is the tenth place is given to a letter that acts as a check-sum that is used to verify the validity of the current code.

Importance of PAN Card

Just like an Aadhaar card and Driving license, a PAN card also has quite a few purposes to serve. People usually think that it has a purpose in Income Tax-related matters only; however, there is more to a PAN card than just that. A PAN card is used in the following places.

First and foremost, the PAN card brings universal identification to all financial transactions that take place. The card helps to prevent tax evasion as it keeps track of monetary transactions, especially of the high net worth individuals whose monetary capacity has the power to affect the economy. When filing income tax returns, tax deducted at source, or establishing any other communication with the Income Tax Department, it is compulsory to submit a PAN number. The PAN card is becoming an important document for various purposes lately. You now need it to open a new bank account. Even to open a Demat account today, a PAN card is important. If you need a new landline connection or even a new mobile connection then again a PAN card is needed. Purchasing foreign currency requires a PAN card too. To deposit a sum of more than 50,000 in the bank you again need a PAN card. If you wish to purchase or sell a vehicle, an immovable property, or other such stuff then again you need a PAN card.

Finding PAN Number using Mobile Number

Losing things can be an honest mistake, especially those that are very important. Anyone can lose a PAN card considering how small and slippery they are, but how do you recover them? The answer is very simple and by following the steps mentioned below you can recover your PAN number in no time using your mobile number.

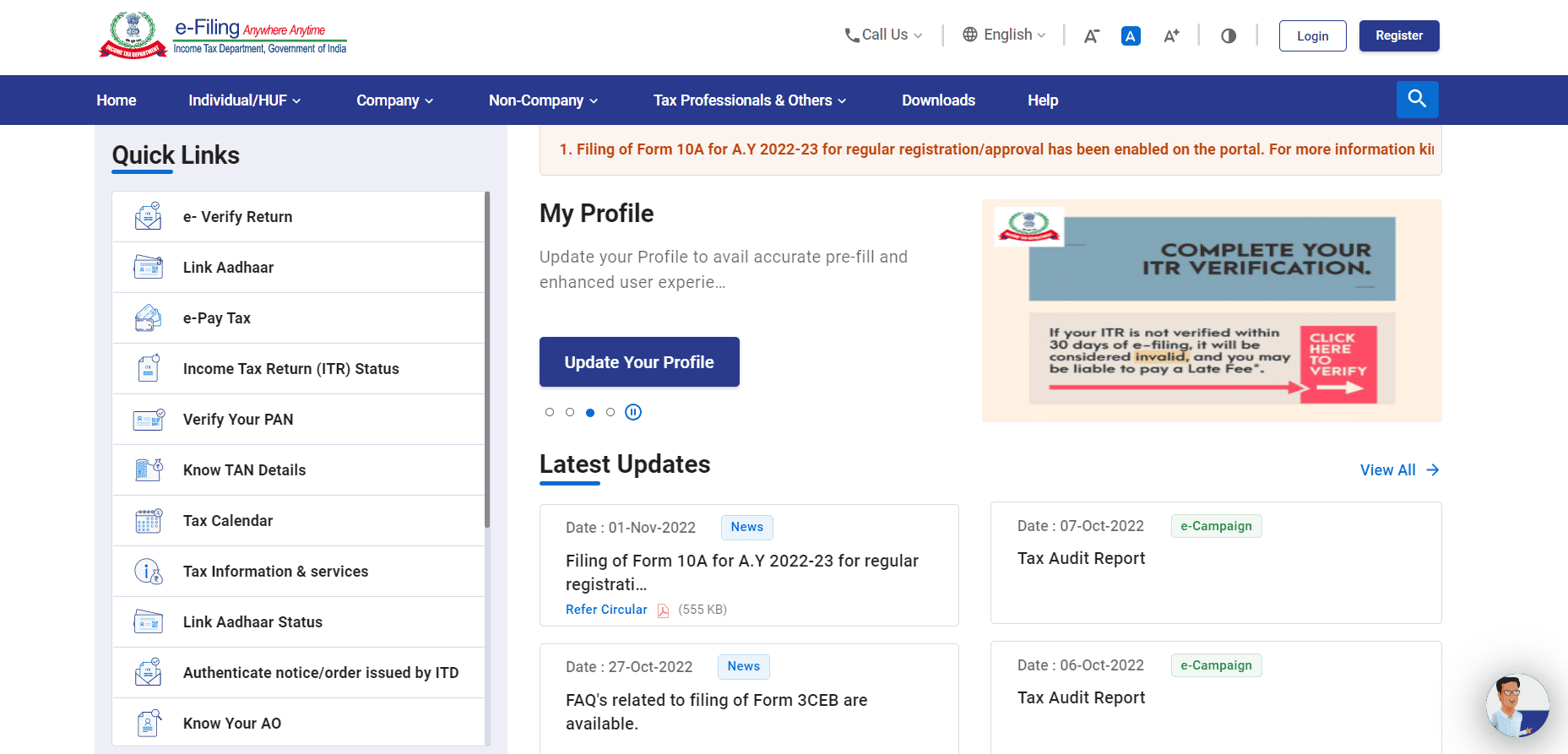

Go to Income Tax e-filling website.

In the Quick links section, click on Know Your PAN option. 3. Enter the necessary details like your birthdate, mobile number, etc.

Now you will receive an OTP on your registered mobile number, enter this OTP on the website and click on Validate.

Now enter your Father’s name and click on submit. Once you have done the steps mentioned above on your screen, you will be shown information regarding your PAN card including your PAN card number. Note: Know Your PAN option has now been removed from the Income Tax e-filling website.

What to do if you forgot PAN Number?

There are a lot of ways to find your PAN number if you ever forgot PAN number. Use your mobile number, email ID, mobile app, or toll-free number and you can easily find your PAN number. Finding a PAN number through mobile has been explained above and similarly, you can use your email ID as well. Or else you can register yourself on the Income Tax Department’s e-Filing website. Make your profile on this page and once that is ready, head to profile settings and then go to my profile, and under PAN details you will have access to your PAN number and other details. Using your email ID, you can send an email to tininfo@nsdl.co.in or utiitsl.gsd@utiitsl.com and you should be able to retrieve the necessary information. If you are using the PAN care app then you can follow the steps mentioned above, in the using your mobile phone section, and that way you should be able to get the PAN number. Lastly, if you call on the Income Tax toll-free number 18001801961 or Protean eGov Technologies Limited toll-free number 1800 222 990, then you should be able to get the PAN number and other necessary details.

What is an Aadhaar Card?

Just like the PAN card, the Aadhaar card is also an identification number, but it is a 12-digit number and serves a different purpose as opposed to the former. Indians and Foreign nationals who have spent 182 days in India in the 12 months preceding the application are eligible for this card. The Unique Identification Authority of India (UIDAI) is responsible for collecting the data and it was set up by the Government of India in 2009, on 28 January. The budget allocated for it stood at 11,366 crores In 2019, August. As of 2021 October, 1.31 Billion people hold an Aadhaar card. The main purpose of the Aadhaar card is to act as an identification tool and for direct benefit transfer, however, there is more to it than just doing that. An Aadhaar card stays valid for your whole life and it is free to obtain the first time around; however, for a demographic change you need to pay 50 rupees, and a Biometric update costs 100 rupees. Aadhaar proudly holds the record of being the largest biometric system in the world.

Other Purposes of Aadhaar Card

In July 2014, Aadhaar was used for a biometric attendance system in public offices for the first time. People were also allowed to check the employees coming in and out of duty in a public office on any given day. The system was used to check the late arrival and absenteeism of the employees. The Aadhaar card began to gain prominence as you were now supposed to have an Aadhaar card to be eligible to apply for passports. In fact, linking a passport to an Aadhaar card has also been in discussion. Next were sim cards that now needed to be linked with Aadhaar cards so that the government could provide people with all its services electronically. Next up, the Employees’ Provident Fund Organization of India now began linking provident fund accounts to Aadhaar. Prisoners were told to be enrolled by UIDAI. Then, men were told to have an Aadhaar card to be able to create a profile on the matrimonial websites in order to save women from falling for a fake profile. Then it was time for getting an Elector’s Photo Identity card linked with their Aadhaar number so that fake IDs could be removed, and the voter database could be error-free. In Hyderabad and Telangana, Aadhaar numbers were linked to people’s ration cards to avoid any duplication of ration cards. Also Read: How to Delete Naukri Account?

PAN Card Details by Aadhaar Number

Above we have discussed various ways by which you can find your PAN card number, however, it is possible to find PAN card details by Aadhaar number as well. It is quick and easy and one more additional way to go about searching PAN details in case you ever misplace it. Follow the steps below.

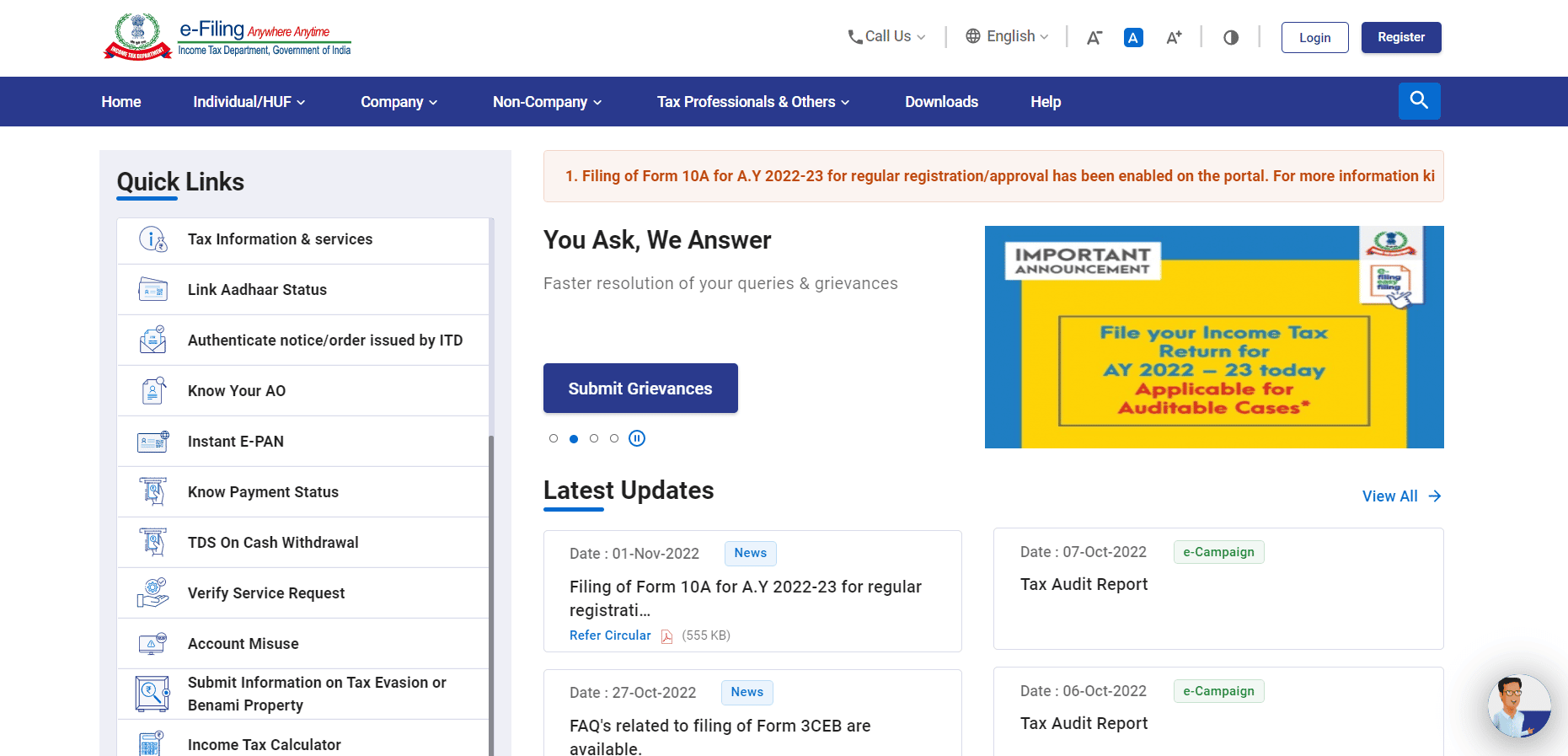

Go to Income Tax e-filling website.

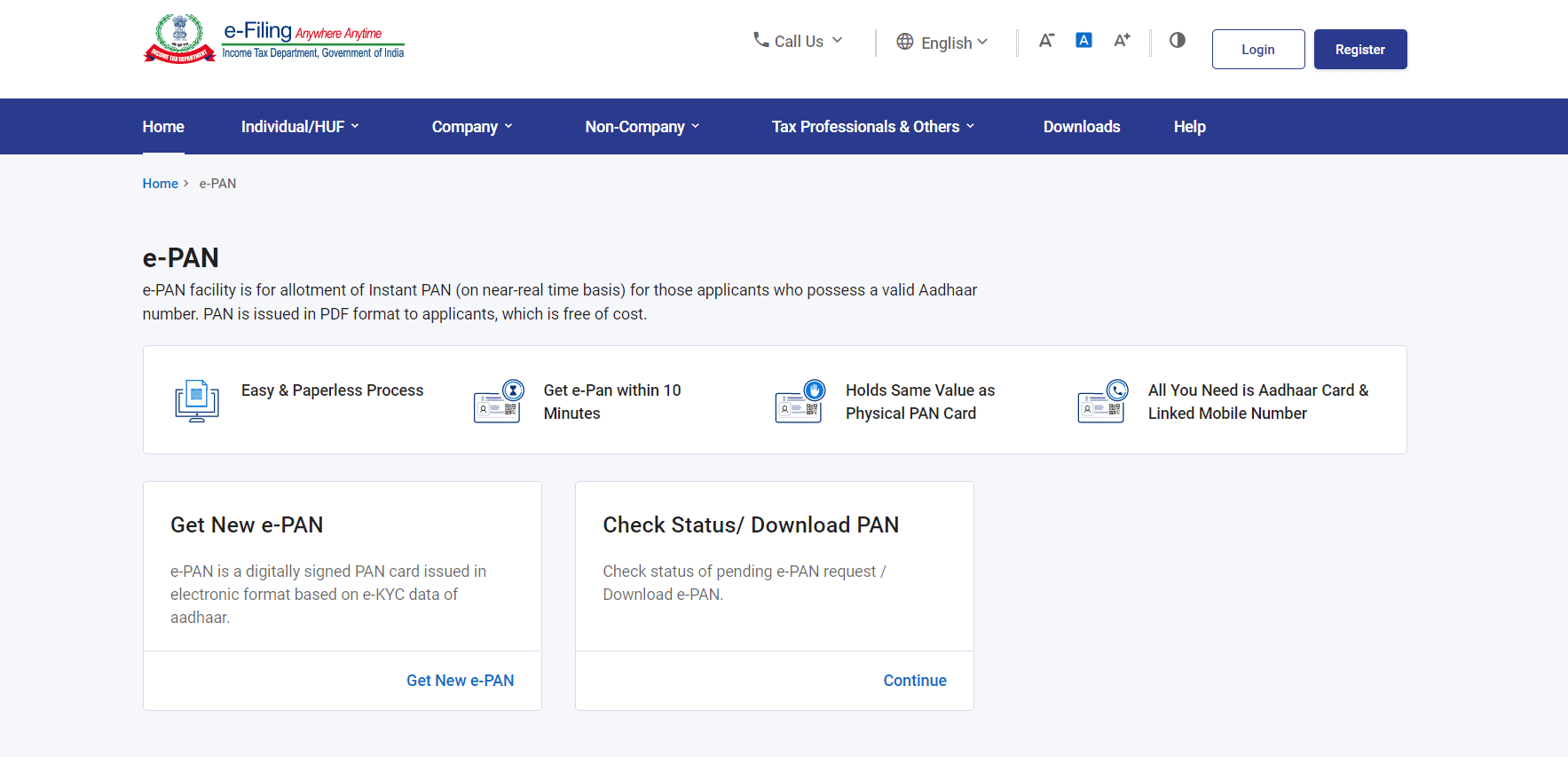

In the Quick links section, scroll down and click on Instant E-PAN option.

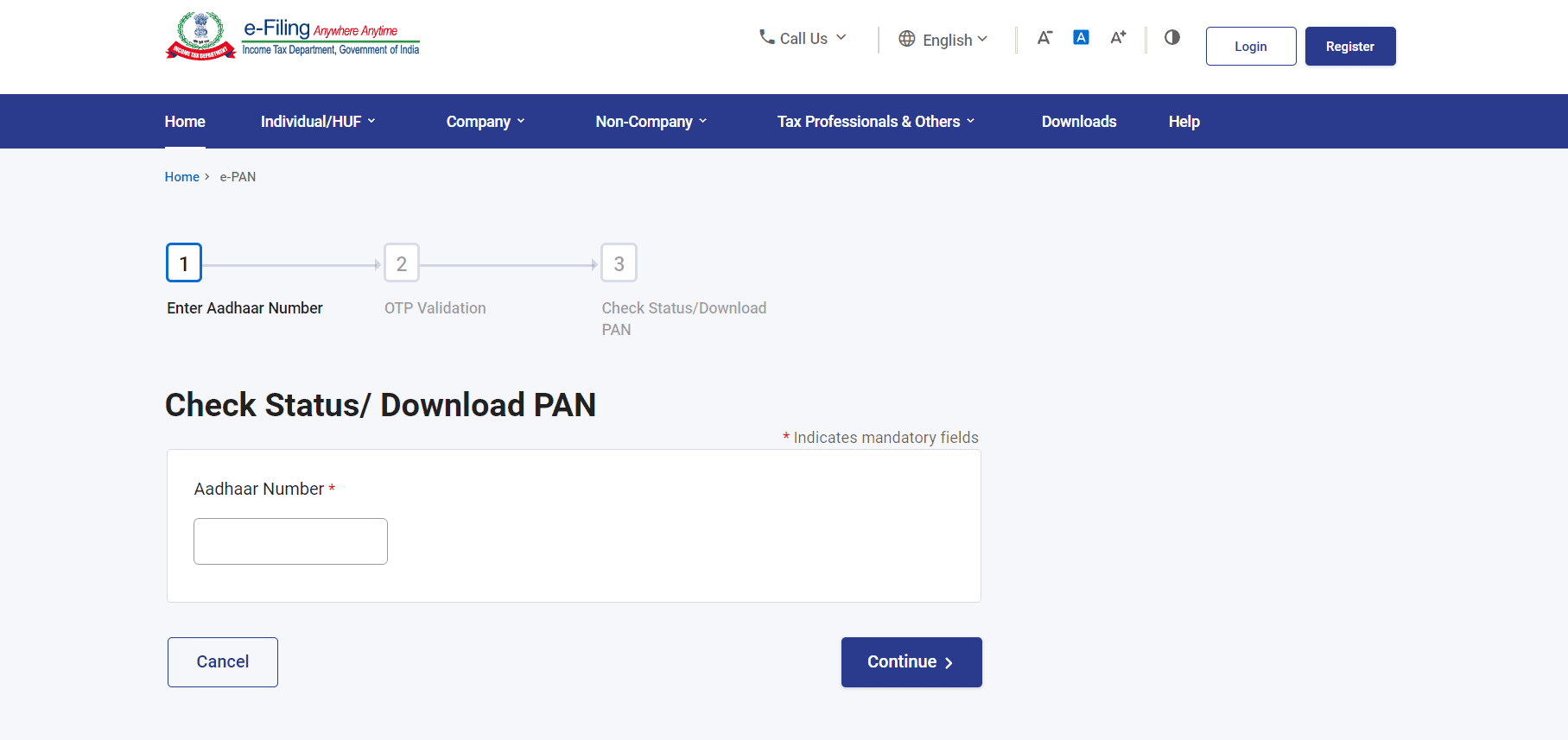

Under Check Status/ Download PAN section click on Continue.

Now enter Aadhaar Number and click on Continue. After this, you will receive an OTP for validation.

Enter OTP and click on Continue. In the next section, you will able to view e-PAN card and you can also download an e-copy of your PAN card containing your PAN card number. The world is slowly entering a futuristic and high-on technology era and who knows there may be more cards and identity systems that come into existence. But for now, all that we have in India is an Aadhaar card, a PAN card, a Driving license, and a few other small-scale documents which are required at different places. We have now informed you about how to find PAN number using mobile number. It is the miracle of technology only that we can retrieve important documents like PAN cards using just our mobile number. For more such interesting content, keep reading MoneyMint.