Stock screeners are extremely useful tools for investors and traders, which help them analyze and filter out stocks based on different user-defined metrics. In simple words, screeners help investors filter out poor quality stocks which in turn helps them make the right investment decisions. There are many stock screeners available for investors to use, but, most of them are highly expensive and not very beginner-friendly. This is where screener.in comes into the picture. Screener.in is free and easy to use stock screener that can be used to find the best stocks for the long term and short term investments. Hundreds of successful investors use screener.in as an integral part of their stock analysis.

How To Effectively Use Screener.in For Stock Screening

In this article, we have listed a detailed procedure to use screener.in like an expert.

Introduction To The Website

As mentioned before, screener.in is a free and easy to use website that can be used to perform fundamental stock analysis. It can be used to read, analyze and filter out companies based on a few metrics. When a user types in the name of the company in the search bar, he is redirected to a stock page where all the details of the company are available. The industry in which the company works, the stock P/E, market capitalisation and book value details about the company are available for users to view. Moreover, the reports presented by this website are interactive, easy to read and beginner-friendly.

Getting Started

To start using this screener.in, all you will have to do is register yourself with the website for free. On the login page, click on Register Now, then you will be prompted to enter your email id and the desired password. Once you enter the required details, you will be registered with the website. Once you have registered yourself, it is time to start filtering out stock. Let’s see how using stock screener like screener.in makes finding good stocks easy.

Query Builder

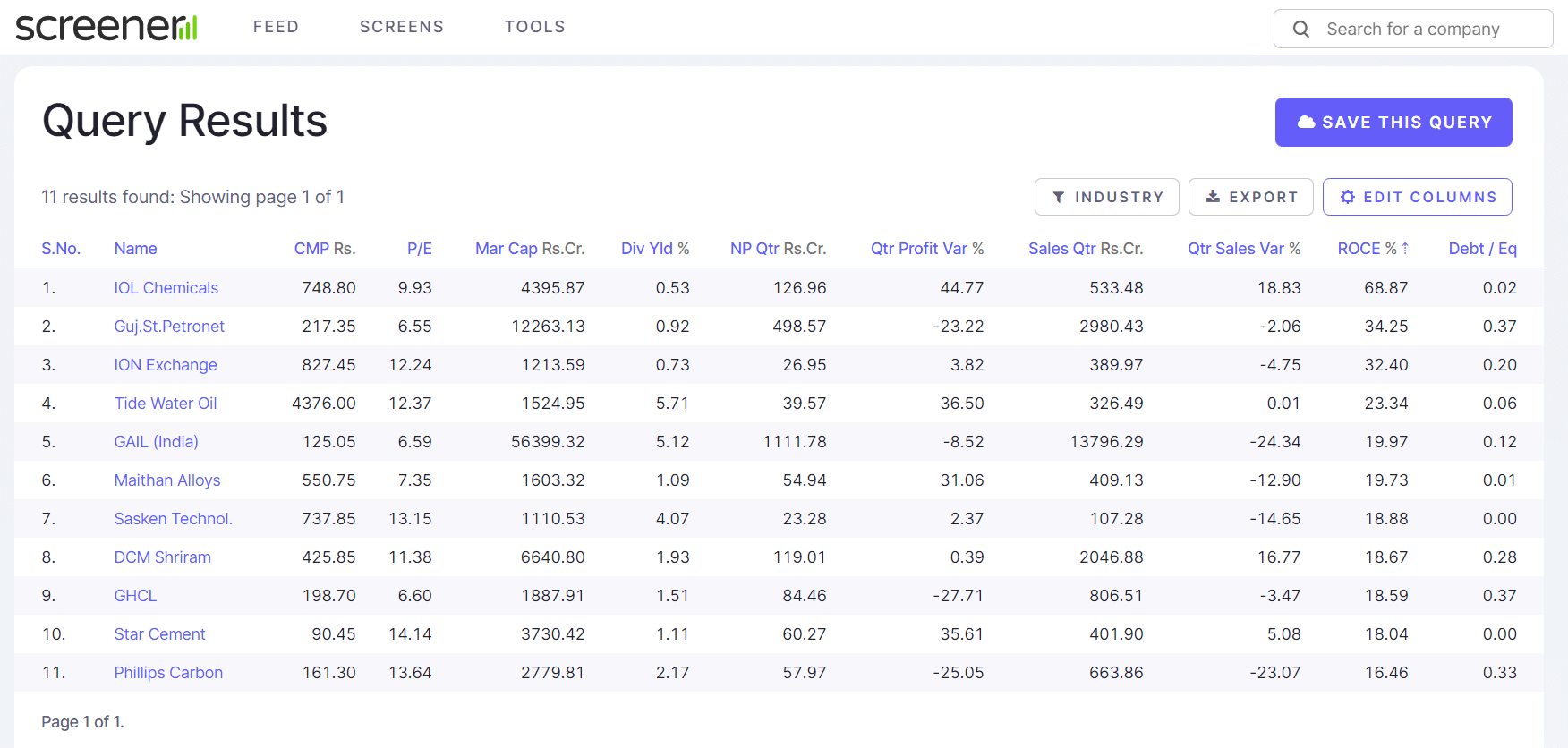

The Query Builder is an extremely powerful tool provided by screener.in. This tool simplifies the search process by providing you with specifically requested data from screener.in’s database. This tool is often overlooked by many but, using the Query builder can make your process of stock filtration and selection much easier. Here is how you can use screener.in Query Builder.

Using The Query Builder

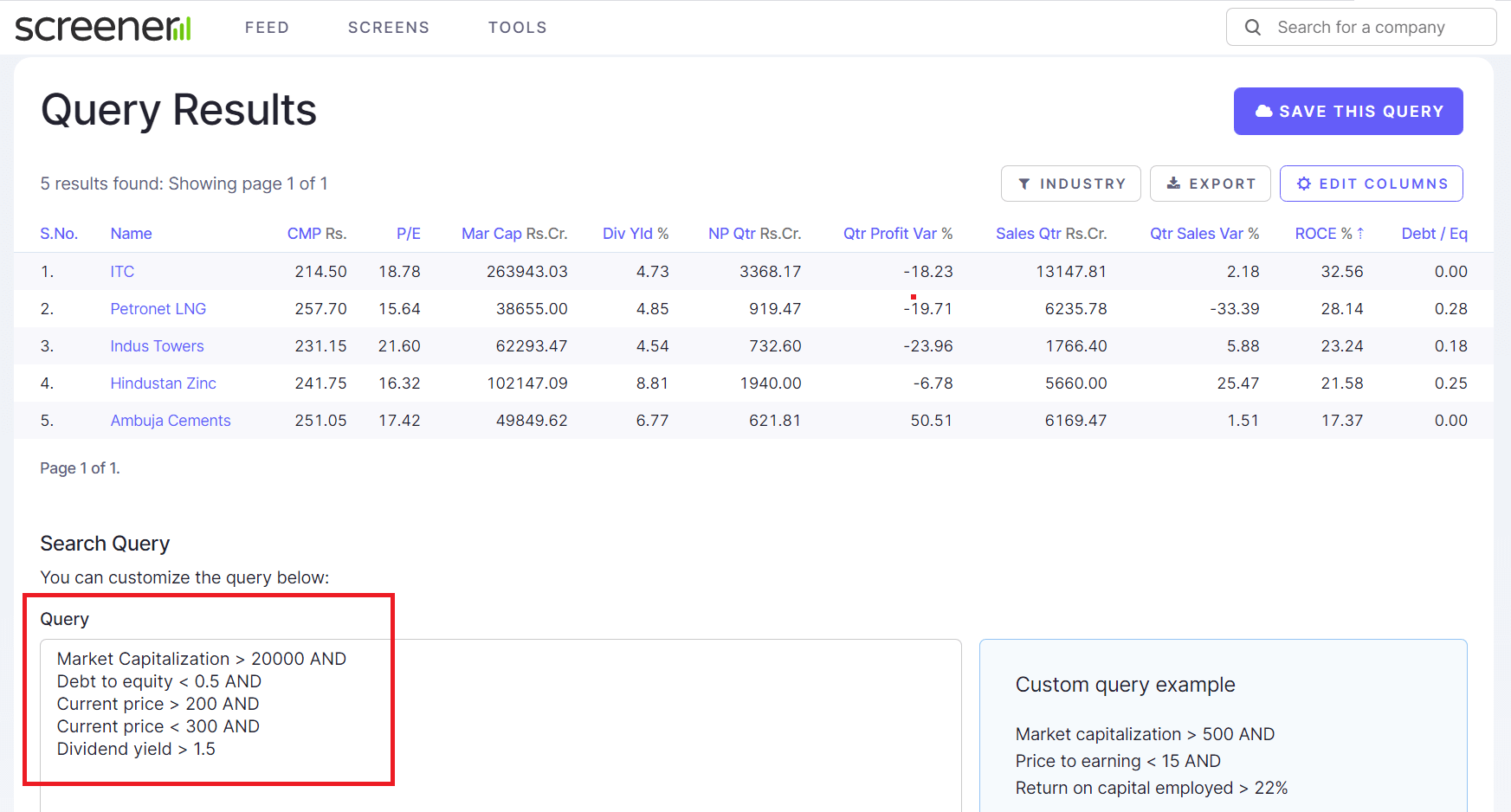

Once you have logged in to your account on the screener website, scroll down to the bottom of the page to find the Query Builder. Now, in the query builder, you can type in a different type of queries to find specific information. Now say that you want to find companies whose price to earnings ratio is less than 20, you can write it directly in the query builder tool. When you enter this in the builder, you will be given a list of all such companies whose price to earnings ratio is less than 20. This is typically a one-line query. This query can also be combined with a few other queries simply by adding AND at the end. Suppose you want to search for companies whose price to earnings ratio is less than 20 and market capitalization is less than 500. Type in All the companies falling into that bracket will be shown as results. You can type in any number of queries in the Query Builder tool, example: This query will show you all the companies that have a market capitalization greater than 20000, debt to equity less than 0.5, current price greater than 200 and less than 300 and a dividend yield greater than 1.5

You can see how this tool aids in stock filtration process by displaying companies based on your specific interests and requirements. Using the Query Builder you can find

Small, mid or large-cap companies Companies with zero debt Companies that fall in a specific price range Penny stock companies Companies with low P/E ratio

Also Read: 7 Best Virtual Trading Simulators for Indian Stock Market

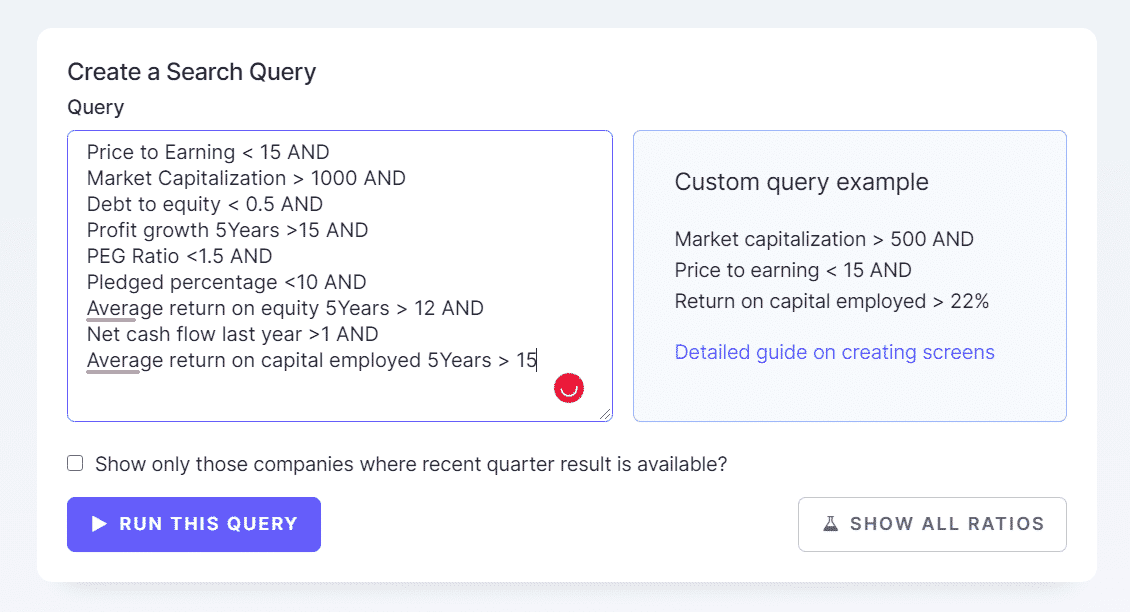

Create Your Own Stock Screen

On screener.in, you can create your own stock screen with the help of the query builder. You can use different ratios like PEG, sales growth, profit growth, the current ratio etc. to shortlist suitable companies and use them for reference in the future. Here is an example of a query used to build a stock screen:

Feel free to experiment with your own ratios and build a stock screen that best suits your requirements.

The Query Builder is a very simple yet extremely useful tool which can make your stock research less burdensome and more interesting. Do not forget to use this tool when performing stock analysis. Also Read: 18 Best Personal Finance Blogs To Follow In India

Features of Screener.in

Screener.in is a powerful stock screener. It comes with a variety of features that help in making stock research easy even for beginners, and this is the reason why it is preferred by thousands of investors across the country.

1. Charts are easy to understand

The stock analysis involves reading and understanding of various charts and graphs. On screener.in, the charts and graphs are available for a period of more than 5 years. This makes it easier for the analyst to study the pattern and decide whether that company is suitable for him or not.

2. Flexibility to calculate various ratios

Screener.in provides a feature to calculate a variety of ratios. Be it profit ratio, sales ratio, P/E ratio or returns on equity ratio, all of them can be calculated in a few seconds as per requirement. Moreover, these ratios can be calculated for a period of 10 years and 5 years to get the right picture of the company’s performance.

3. Pros and cons are listed

Screener.in has a unique feature of listing the pros and cons of a company which can help you make the right decision. These pros and cons are listed based on the company’s market performance in the last few years, profits and recent new flows.

4. Cash Flow Statement

Screener.in provides the cash flow statement of every company for the past five to years to analysts. Reading the company’s cash flow can give you an idea of its performance and know if it is right for you.

5. Latest news and information

Latest news about the company and all the latest information is provided by screener.in. All the recent announcements made by the company are also listed on the website. This helps you better understand the company’s future.

6. Quarterly and Annual results

The quarterly and annual results of a company should be thoroughly read before investing in it. Screener.in provides all the details of the quarterly and annual results for the past 10-12 years. This helps in truly analyzing the company’s consistency and performance.

7. Comparison with peers

Screener.in has yet another interesting feature of providing peer comparison. In other words, when you are analyzing a company, you can detail all of the competitors and where this company stands in comparison to its peers. This makes it easier for you to select the right company. Screener.in is a very simple yet effective stock screener that aids in stock analysis. With the help of this tool, you can shortlist all the companies that are suitable for you and then make the right investment decisions. Recommended: 9 Best Stock Screeners For Indian Investors We hope this guide was helpful and you will be able to effectively use Screener.in to find good stocks. If you still have any queries or feedback then feel free to reach out using the comment section.