LazyPay Payment App: Why do you need it?

Today, the app market is full of apps that help with credit management, EMIs, loans, and other such services. LazyPay is one such app that you need but didn’t know about. With this app, you can get easy and quick financing. The app lets you use the buy now pay later feature. By just doing a simple KYC procedure on the app you are good to go and can borrow a personal loan via the app. Let us learn more about LazyPay payment app.

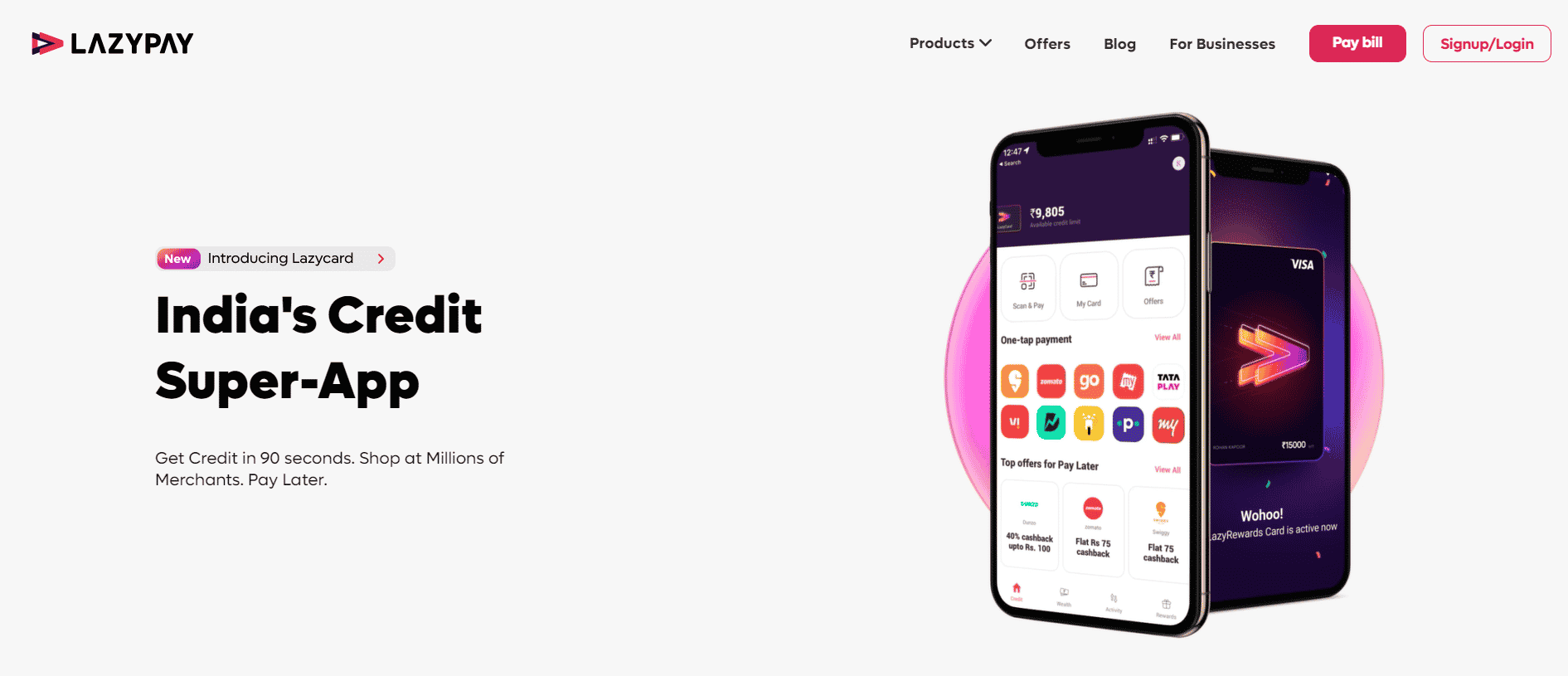

What is LazyPay?

As mentioned above, LazyPay is a finance provider and it helps you get the money that you don’t have today so that you can fulfill your wish now and pay later. The sum that you can borrow from LazyPay is any amount up to 1 lakh and for that, you are charged anywhere between 18 to 25% interest. To be able to take a loan from LazyPay you must be in the age range of 22 and 55 and must be a citizen of tier 1 or tier 2 city. Also, you must be a salaried person to be eligible for a loan from the platform. ID proofs like Aadhaar card, driving license, etc. along with address proof like on a utility bill or something else, details of your bank account and a selfie are the documents required to get you to be a member.

Features of LazyPay

What is it that makes LazyPay payment app special? Well here are some features of LazyPay that make it stand out.

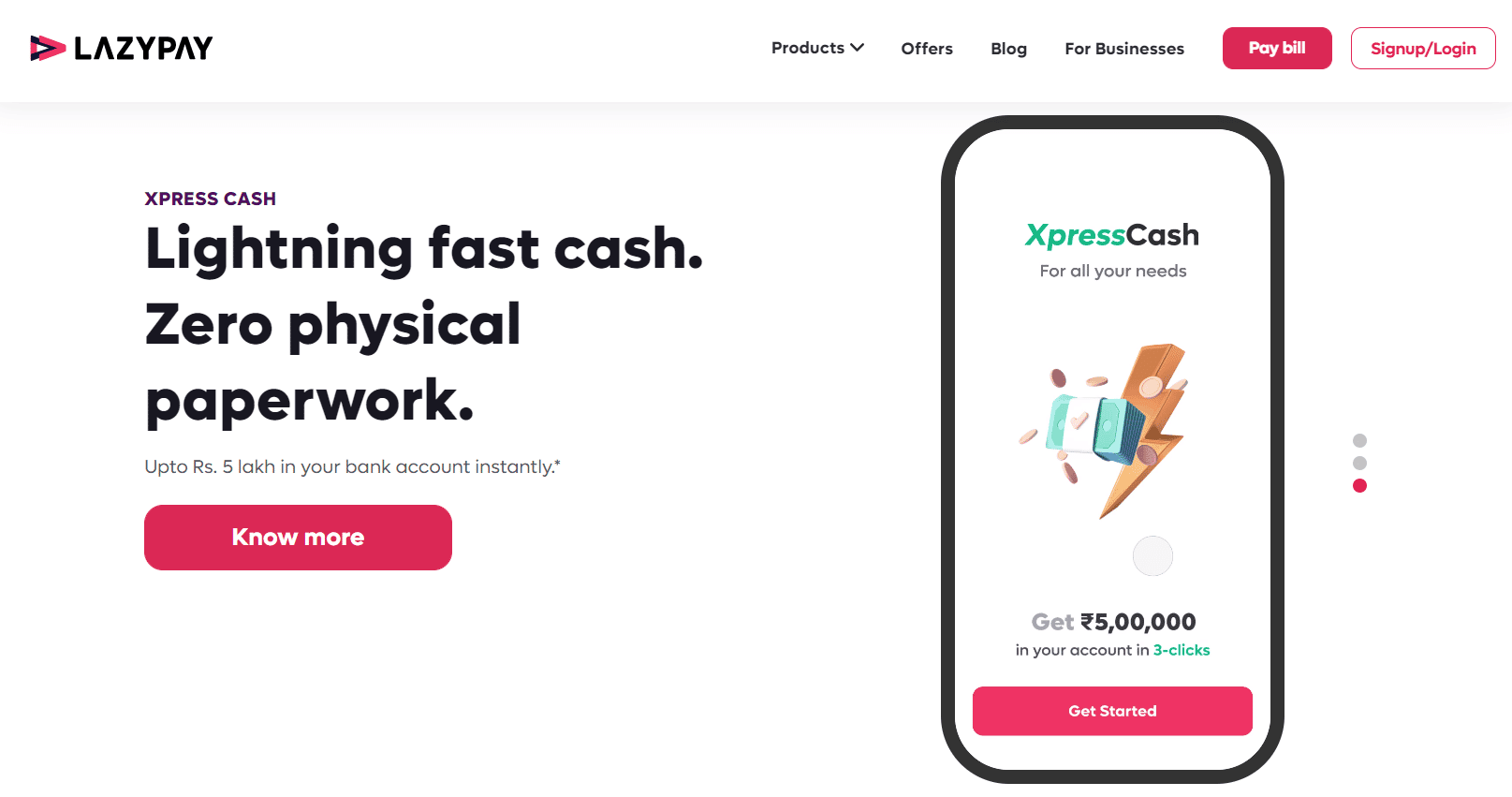

The team behind the app proclaims it to be not only the easiest but also the quickest way of making payments. And if there is even a slight truth to it then you know that the app is surely doing quite a few things right. LazyPay has been launched by PayU India and the former is a very trustworthy and reputed service-providing company. LazyPay states that there are 6 crore eligible users, which is surely a very huge user base to have. The app has been downloaded more than 60 lakh times as of now. More than 2,000 crores have been given out by LazyPay to its huge customer base. LazyPay now has a Lazy card as well which is a credit card that comes with a 5 lakh limit, has a quick and paperless KYC, and tons of big and better than ever rewards to give away. Lastly, the interest you need to pay is only on the amount used by you and not the whole sum borrowed.

LazyPay Loan Benefits

Apart from the features we have mentioned, LazyPay makes the process of taking a loan, simple. Here are all the loan-related perks you get in LazyPay.

You can take a loan of amounts varying from 10,000 rupees to 1 lakh on the app. The interest rate charged by the company is very affordable when you look at the repayment tenure and the loan amount. The repayment tenure of 3 months to 24 months is very convenient and attractive for a lot of customers of the app. The amount you borrow and repay using the platform becomes a part of your record that is considered for your credit score and so by being a good customer of the app you can help your credit score to improve. Documentation required for getting a loan from the platform is minimal, which is again great for the customers. With a one-time approval, you can use the loan amount for a lifetime. To take a loan from this platform you do not need to have any collateral kept against it and that is surely one big yes-yes point. Another great thing about taking a loan from LazyPay is not having to make a trip to the bank.

If you are someone who wants a loan, you know for sure that you want to get done with it quickly and with LazyPay you get your credit in just 90 seconds. Also Read: 7 Best UPI Payment Apps in India 2022

LazyPay Login

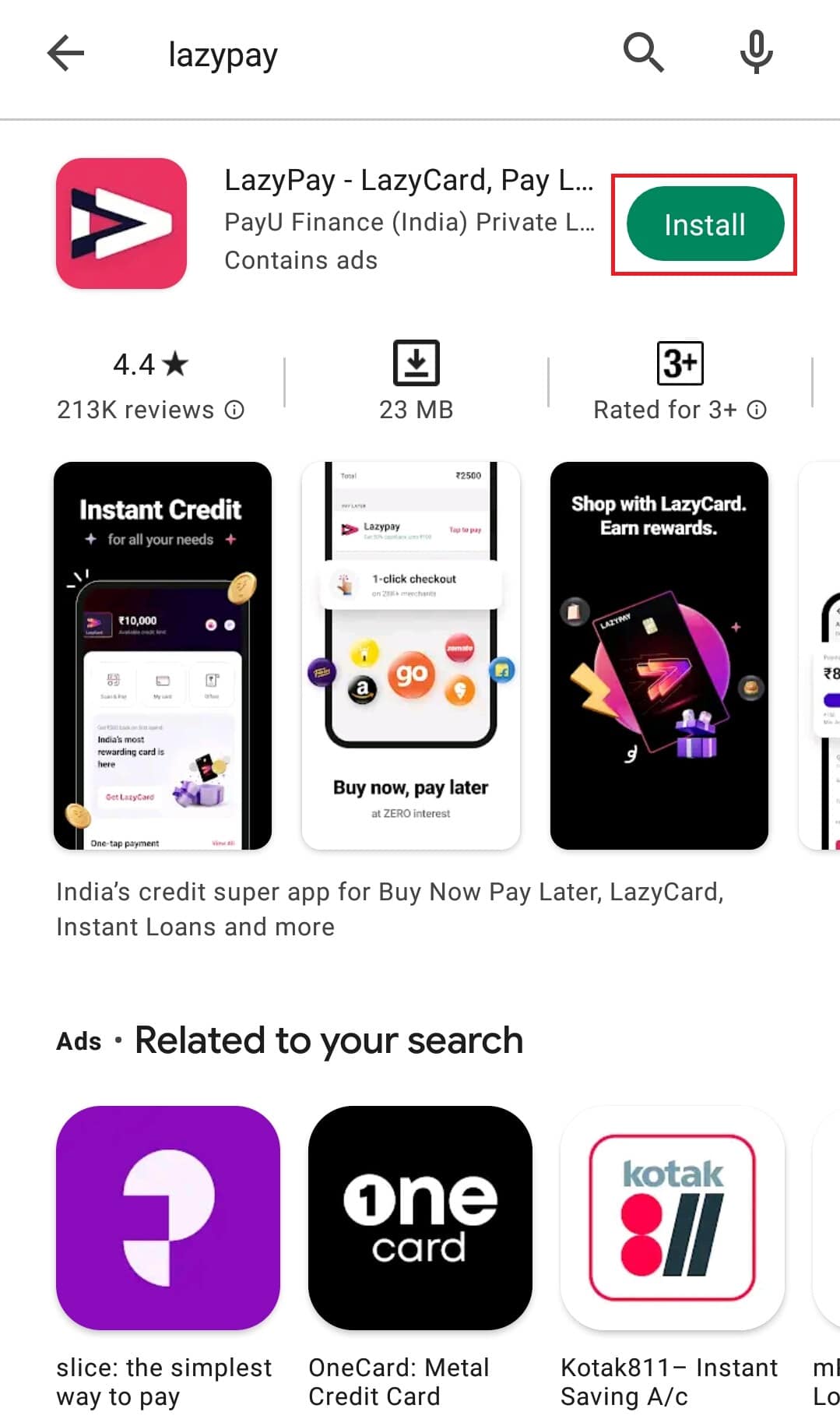

Like with other things, LazyPay login is as easy as any login process that the users today have to go through. Below we have a series of screenshots showing how to go about downloading LazyPay from the Play Store and then putting your mobile number on the app to get started. Here is how you do LazyPay Login:

Open Play Store.

Search for LazyPay.

Click on the LazyPay app and then click on the Install button as shown.

Open the app and register as a new user on LazyPay. Once you have successfully completed these steps, you have now entered LazyPay payment app. This concludes LazyPay Login process. From here on you can now take loans, make purchases for which you can pay later, and earn rewards on meeting certain criteria. The interface of the app is simple and the app itself is very easy to use and all the options are easy to locate and so you should not have any trouble using the app once you have completed logging in the app.

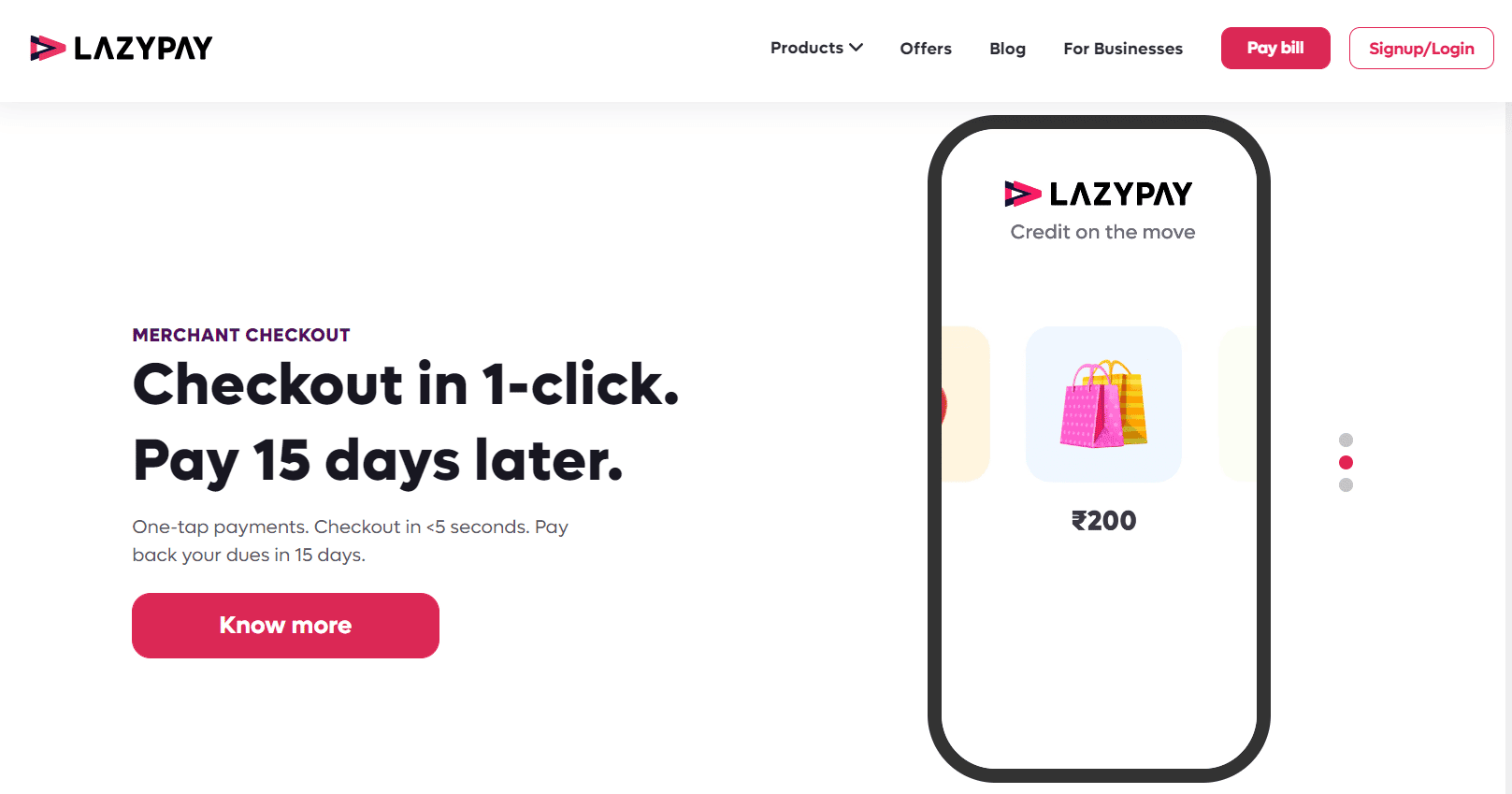

LazyPay Payment Gateway

After learning about LazyPay login, let us shift focus to LazyPay payment gateway. LazyPay has not one but two parent companies and they are Naspers and PayU and their partnering bank is SBM. When dealing with online payment apps it is necessary to always be careful and attentive. Considering the frauds that happen when using online mediums, it is only right that terms like payment gateway get enough importance. Since we are on the topic of payment gateways, we need to find out what is LazyPay payment gateway being used for. As it turns out PayU, which is one of the two parent companies of LazyPay, is the payment gateway used by the app. The company is a payment service provider to online merchants and is headquartered in the Netherlands. Founded in 2002, the company has offices in 17 locations worldwide and has 1,500 employees in its ranks. Interestingly, the parent company of PayU is Naspers. So with a solid parent company which is also its partner in another joint venture we have here a very safe and reliable set up one that the customers don’t need to worry about much.

LazyPay Credit Limit

Be it a bank or a private institution, each one has its own credit limit and its own terms and conditions regarding payment, duration, rate of interest, etc. With LazyPay payment app you also have a similar case where there is a LazyPay credit limit that you have to abide by. It’s not so much about an idea as it is about that they have set an upper limit to the amount that you can borrow from them with a return period, rate of interest, and other stipulations predetermined. LazyPay allows any user to take a loan/credit of an amount ranging from 10,000 rupees to 1 lakh rupees. Even with this amount, the interest that you have to pay is only on the amount that you spend and not what you borrow. The amount commands affordable interest at 18 to 25% and is payable within a range of 3 to 24 months. If you are looking to grab more credit, then LazyPay now has its own credit card as well with a cap limit of 5 lakhs. Also, LazyPay charges a processing fee at the lender’s discretion so all in all you have got a good deal for yourself when you choose to get associated with LazyPay. You can also earn rewards and improve your credit score with LazyPay, so it really is the whole package. Also Read: CRED Review: Your Credit Card Payment Solution

LazyPay Payment Dates

Due dates play an important part for any credit giver. These dates are responsible for deciding the rate of interest; due dates separate good borrowers from bad borrowers. Due dates have the power to put a dent in your credit score or to make your credit score look neat and favorable. Let us now learn about LazyPay payment dates. LazyPay also has its own billing cycle which you need to follow if you wish to be on the good side of borrowers. However, in the case of LazyPay payment dates, there are two criteria, or rather two dates that can be your payment date depending on your billing cycle. Firstly, if you make transactions between the 1st and 15th day of the month then you get your settlement on the 16th day and your due date falls on the 18th day of the month. In the second case, when you make your transactions between the 16th and the last day of the month, you get your settlement on the 1st day of the next month, and your due date is the 3rd of the next month. Apart from this, if a user has a monthly billing cycle then their cycle is somewhat like a mix of the above two cycles. The transactions done between the first and last days of the month are taken into consideration and their settlement is shared with you on the first day of the next month. Now you know all about LazyPay payment dates.

Final verdict on LazyPay

We have laid bare everything that we think there is to know about the LazyPay payment app. The market is full of apps of this kind and some of you may have your choice of apps already installed on your phone. For those of you who don’t, we can only say that with all these great benefits and features that this app has to offer it surely deserves at least a chance or consideration from you. Today everything is becoming easier by the day and it is apps like LazyPay that are pioneering this change. Did you ever think in your wildest dreams that borrowing a loan would be so easy? No one knew that 90 seconds was all that it would take to get a loan of as much as 1 lakh rupees that too with such affordable interest rates and easy terms and conditions. Surely in a few years from now, things might become even simpler, although that does not seem possible now. We hope you have learned all about LazyPay payment app including LazyPay login, LazyPay payment gateway, LazyPay credit limit and LazyPay payment dates. Now it is time for you to try this app and enjoy its facilities.