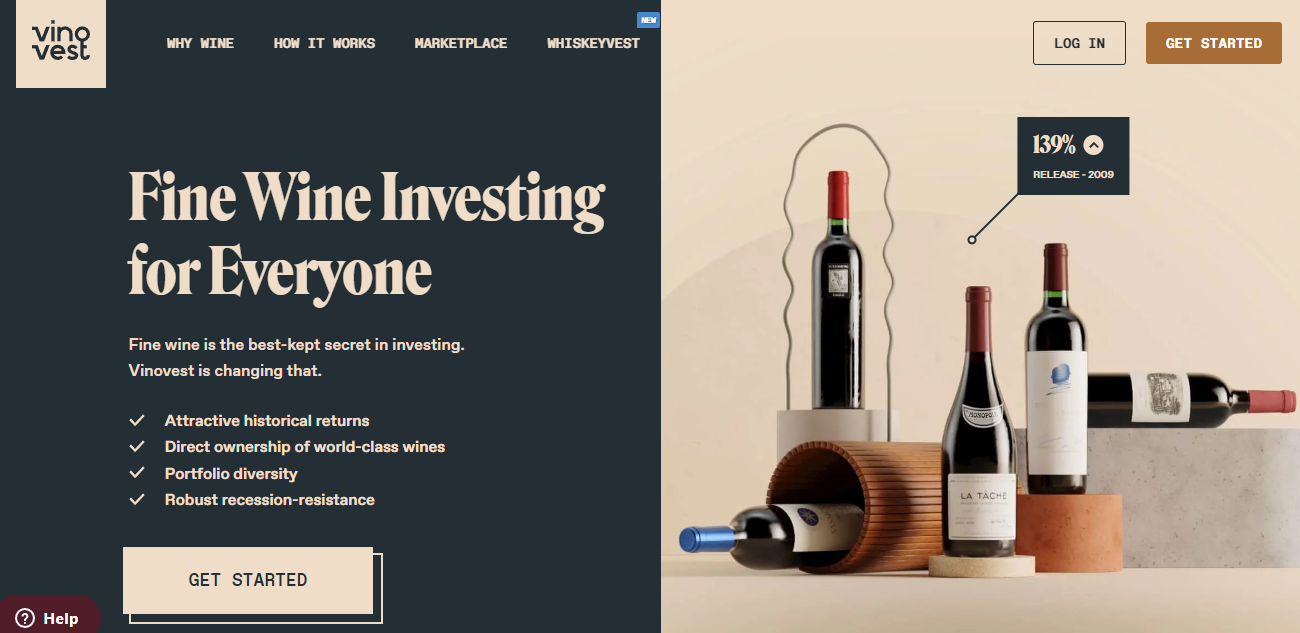

Vinovest Review: Diversify Your Portfolio with Wine

Diversification of stocks is vital as it protects your investments in case one of them goes bust. There are various ways to diversify your assets and Vinovest is one of them. It gives you the chance to invest in something unique. Let us learn more about them in our Vinovest review.

What is Vinovest?

When some investors gain a better understanding of their stock portfolios, they may begin to look for alternative investments to diversify their risk. Wine is one alternative asset class that’s gaining traction. Vinovest is a website that makes fine wine investing easier, including the ability to add vintages to your collection based on master sommelier recommendations. Furthermore, Vinovest handles the tedious task of authenticating and storing your wines. Many people may find the idea of investing in fine wine strange, but according to Vinovest, fine wine has given investors an annualized return of over 13%. Cofounders Anthony Zhang and Brent Akamine founded Vinovest in 2019, and it is headquartered in Culver City, California. The business is currently receiving seed funding from capital management firms as well as some individual investors. The website is home to a technological platform that lets regular people invest in or purchase expensive wine. The platform employs sommeliers, or wine experts, who recommend the best vintages for your investment portfolio and personal palate. Vinovest also offers the physical setup needed for wine storage. This enables you to enjoy the advantages of a wine cellar without actually owning one. Learn more from this Vinovest review.

What is Wine Investment and it’s benefits?

It’s critical to understand how the market works wherever you’re learning how to invest money. Investing in wine generally entails purchasing bottles of wine that have the potential to increase in value over time. Fine wine investments are appealing to those who believe the wine market has a bright future. The fine wine market includes a wide range of vintages that are thought to be long-lasting, rare, and in high demand. If you go to the local grocery store and buy a bottle of mass-produced wine for a few dollars, you’re unlikely to be a successful wine investor. Furthermore, wine investing may be appealing to someone who simply enjoys wine and wishes to include it in their portfolio as an alternative asset. It’s crucial to keep in mind that wine is frequently regarded as a long-term investment and lacks the liquidity of other investments, which can be quickly converted back into cash. To get the best returns, you should hold your wine investments for at least three years. Let us continue this Vinovest review and cover Vinovest stock.

Vinovest Stock and Marketplace

When Vinovest’s wine experts determine a vintage is likely to increase in market value, the company buys and stores the bottles. Through its connections and subscriptions, it purchases wine at a discount from its retail cost. In general, Vinovest takes pride in selecting investment-grade wines from a diverse range of countries that have the potential to appreciate value over time. The Vinovest stock and marketplace, where you can buy and sell individual bottles for and from your portfolio, is immediately accessible to you after signing up. Since these bottles do not count toward the $1,000 minimum investment needed to purchase into an algorithmically generated portfolio, there is no minimum investment required to begin using the marketplace. A 3% early liquidation fee is required if you want to sell wine you purchased through Vinovest within three years of the original investment. Also Read: List of Top 10 Stock Exchanges in the World

Client Tiers of Vinovest

Although they can be stored for a long time, wines do have a “shelf life”. The wine will eventually need to be sold or consumed. You can order a bottle of wine from Vinovest stock to be delivered to your house whenever you want to drink it. Vinovest allows you to directly purchase particular wine bottles when you invest. The platform requires a $1,000 minimum investment to get started (although that amount is soon anticipated to drop to $750). A typical $5,000 wine portfolio would contain 45 to 60 bottles of wine, representing a range of nations, years, and styles. Once you have a bottle of wine, Vinovest will safely store it for you. Read this Vinovest review to learn more.

How is Wine stored and insured?

As for storing the commodity, Vinovest keeps your wine in facilities in the United States, Denmark, France, Singapore, and the United Kingdom. Storage facilities can avoid value-added taxes (VAT) and excise duty taxes because they are bonded, which means they don’t have to pass through customs. Wines are completely insured to their market value at the time of the claim while being stored and shipped.

Shipping of Wine

Vinovest offers full shipping insurance. When buying wine through the marketplace, you can ship individual bottles. As per this Vinovest review, you can have a bottle of wine shipped to you if you bought it, whether it was on the market or in a portfolio. Wines acquired by Vinovest for your managed portfolio, i.e., those not obtained through the marketplace can only be shipped by the case. To put it another way, you must ship an entire case; you cannot remove a bottle from one collection and a separate bottle from another. This safeguards the wine’s resale value because its network of customers is more likely to purchase cases of wine than individual bottles. Let us now learn about Vinovest fee in our Vinovest review.

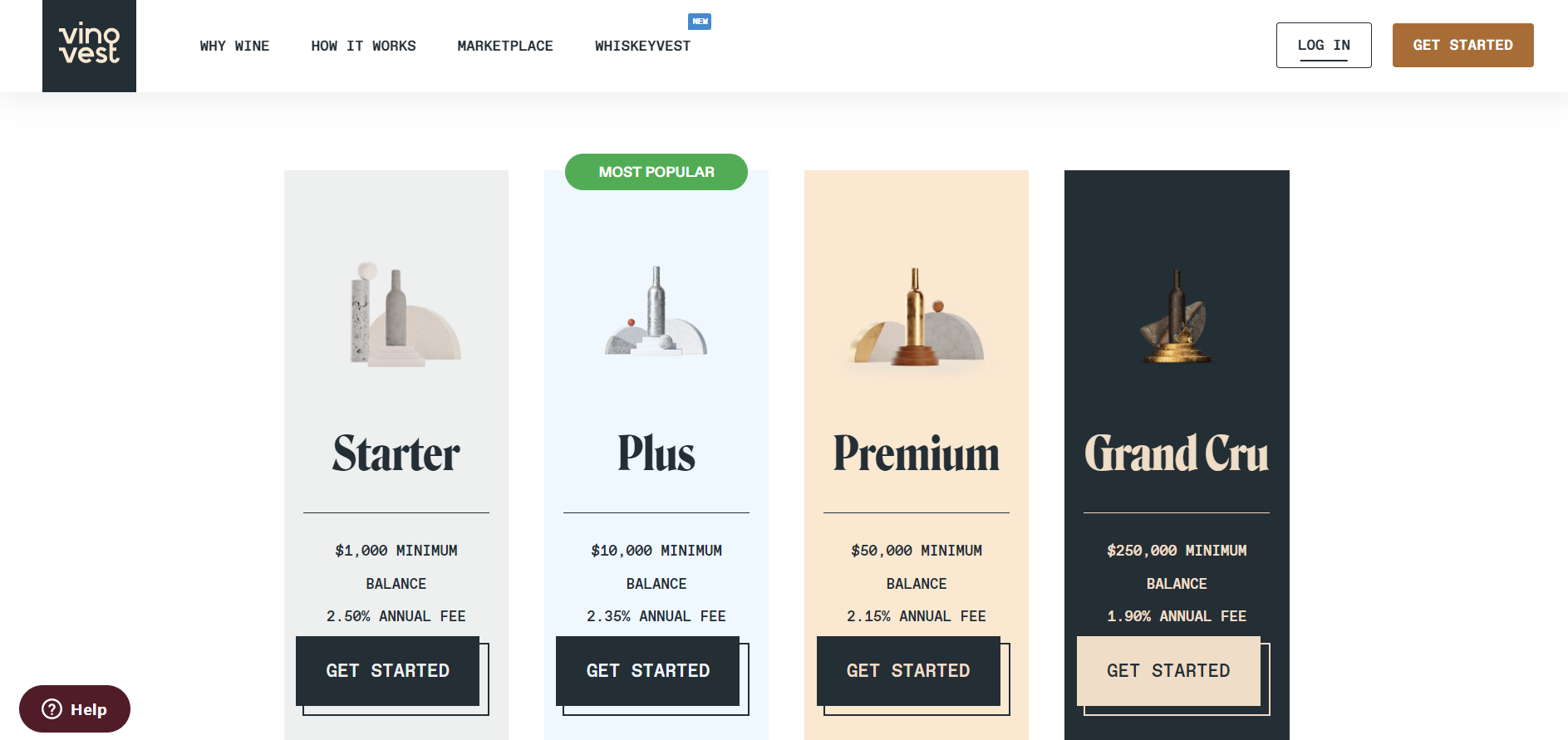

Fees and Pricing Plans

Continuing on the investment bracket, there are four investment plans provided to get better Vinovest returns:

Standard

With this program, you must invest a minimum of $1,000, and an algorithm chooses the wines for your portfolio. You still have access to fine wines stored in locations all over the world. For this level, Vinovest fees are a 2.85% annual management fee.

Plus

Plus clients are accounts with a balance of $10,000 to $49,999. The plan is identical to the Standard plan in every way except for the lower fees of 2.75%.

Premier

Account sizes between $50,000 and $249,999 are covered by this plan. The management fee has been reduced to 2.5%. You gain access to a human advisor who can help you create and manage your portfolio, you have more options for customizing your portfolio, and you can invest in wine futures.

Grand Cru

At Vinovest, you can join the wine advisory council, which is made up of wine directors, master sommeliers, and winemakers, if you’re willing to invest $250,000. You can also get access to rare wines. A further advantage is that you pay the lowest annual fee of 2.25%. And the rates vary, There are no set shipping costs at Vinovest. Prices will depend on the delivery location, the wine’s origin, the value of the shipment, and the wine’s weight. Taxes and tariffs will probably be applied here, both when your collection is taken out of the bonding facility and when the package is delivered to your home.

Who Can Open an Account?

For people who are interested in alternative assets and have a moderate to high-risk tolerance, Vinovest is probably a good fit. You must be at least 21 years old if you reside in the United States to open an account with Vinovest. With Vinovest, you can purchase alcohol that is legal to consume in the United States at this age. You might additionally be asked to submit proof of your identity, such as a photo of your driver’s license. A funding source must also be mentioned. Credit cards, wire transfers, paper checks, bank transfers, bank transfers via BitPay, and cryptocurrencies are all accepted by Vinovest. Before you start investing in wine using Vinovest, carefully consider your portfolio’s objectives and long-term investing strategy and read this Vinovest review.

Taxing the Wine

Collectibles taxes apply to wine gains. As long-term capital gains rates are limited to 20%, this is an important factor to take into account when comparing the returns of collectibles to those of Vinovest stock. Let us now cover some pros and cons of this platform in our Vinovest review.

Pros and Cons

At the moment, portfolio management can only be done using the website because Vinovest doesn’t have an app. You could access the website using the browser on your mobile device. An app is being built, according to Vinovest. Read the Vinovest review pros and cons to get a better idea.

Pros

On your behalf, Vinovest chooses and stores best-in-class wines. Wines kept in storage are covered by insurance. Wine can be purchased for less than retail costs.

Cons

$1,000 minimum investment is required to get Vinovest returns. If you liquidate wines for your account within 60 days of the initial purchase, there is an additional charge. Nothing can be customized unless you spend at least $50,000.

Also Read: SpaceX Stock Price Chart Analysis

Useful Tips for Successful Wine Investment

First of all, buying wine does not take the place of other types of investments. Because of its long-term stable growth and relative resistance to recessionary pressures, wine performs differently as an asset than your stocks and shares.

- Choose the best wines for yourself: With your objectives in mind, it’s ideal to collaborate with a wine investment specialist like Vin-X to find the secondary market’s top investment wines that are right for you. The market is diversified by region, vintage, and wine producer (brand), so to maximize your profits, you should seek out wines with excellent provenance and assemble a diverse wine portfolio.

- Choose a suitable time to take an exit position: To achieve your objectives, you must track performance and make plans to sell your wine investment at the ideal moment. As experts, many advice that you keep yourself informed about the worth of your wine, the prevailing market trends, and the best time to sell so you can make the most tax-efficient gains.

- Be specific about your investment objectives: Try answering the following questions to determine your goals- How much do you want to invest, for how long do you want to hold your investment, what rate of Vinovest returns do you hope to achieve, how “liquid” do you need your wine to be, and if you’re a collector, is there a wine or region you want to add to your portfolio?

- To maximize your gains, stay informed: Global political and economic developments, as well as elements that affect supply, like the weather and disease, have an impact on the price of fine wine. New markets have emerged due to the shifting demand for wines from various regions or brands. For the best returns, you should stay current as a wine investor. Vinovest is a reputable investment platform that enables those outside the wine industry to invest in the fine wine market by purchasing the bottles they want. It offers storage, insurance, and a selection of wines that are unavailable to the general public. Wine is an alternative asset class, but compared to real estate or buying gold, wine prices are thought to be less volatile. Your unique situation and portfolio strategy will determine whether Vinovest is a good investment. Some people may find wine to be a wise investment, while others may not. Before taking any further action, carefully consider your investment and financial requirements and read the Vinovest review in detail.